Many Muslims own property, but few are sure how Zakat applies to it.

With so many property types—rental homes, land for resale, under-construction buildings—it’s easy to get confused. Not knowing when and how to pay Zakat can lead to unintentional non-fulfillment of this key Islamic duty.

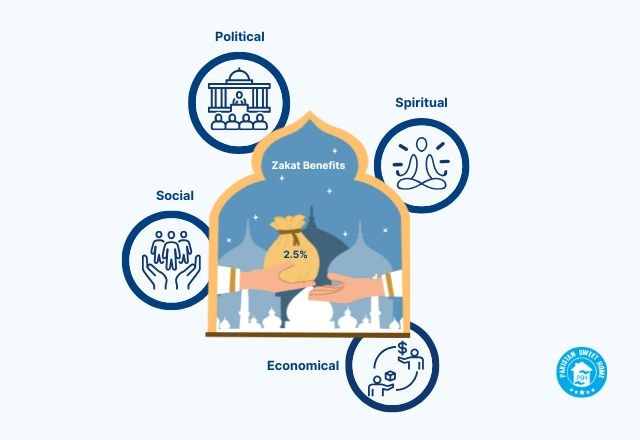

Zakat on property is calculated at 2.5% of its eligible value, but not all property qualifies—this depends on the type, usage, and intention behind ownership.

Let’s further dive into the details of zakat on property.

How to Calculate Zakat on Property?

Calculating Zakat on a property is straightforward if you follow these steps:

Step No.1. First, calculate your total assets eligible for Zakat, including money and other assets.

Step No.2. Then, assess the value of any pieces of land, rental properties, or buildings you've owned for over a year. Add this to your total assets.

Step No.3. Finally, multiply the total worth of your assets by the zakat percentage on the property, which is 2.5%, to determine the Zakat amount due.

Nisab of Zakat on Property

The Zakat includes properties if their value exceeds the Nisab standard, which is 3 ounces of gold (87.48 grams), 21 ounces of silver (612.36 grams), or their equivalent in cash.

As the prices of gold and silver fluctuate, it's important to consider the current market rates before calculating Zakat. Research the prevailing prices of gold and silver to accurately determine the Zakat amount.

Formula of Zakat on Property

Here is the formula of zakat on property:

Zakat Amount = Total Value of Property × 2.5% |

Here is an example of zakat on property:

Total property value = Rs. 1,500,000

Total Value of Property × 2.5%

Rs. 1,500,000 * 2.5% = Rs. 37,500

Zakat amount due is Rs. 37,500, which can be paid throughout the year.

Note: If your rental income is deposited into a central bank account along with your other cash, there's no need to calculate it separately, as it will be part of your overall cash amount.

When Is Zakat Due on Property?

The answer to when can not be yes or no.

Some properties require Zakat, while others do not.

As a property owner, you are obligated to pay Zakat annually for property purchased to sell in the future to generate capital gains.

Properties that Are Not Liable for Zakat

- Your primary residence is where you live with your family.

- Properties used for business or trade (Zakat is on business profits).

- Agricultural land (Zakat is due on the income from it).

- Rental properties (Zakat is on the rental income).

Note: Zakat is not obligatory on all assets, but it applies to those generating income.

Types of Zakat on Property

Following are the different categories of Zakat applicable to various forms of property ownership and investment, ensuring clarity and understanding:

Zakat on Rental Property

If you buy or build property to use, like a house or shop, for rental income rather than selling, there's no zakat on that property.

But when you get rental income, it becomes cash, and you'll pay zakat on it along with your other money and assets when you calculate your zakat.

In the Hanafi school of thought, Zakat on property on rent is calculated as 2.5% of the net rental income.

For instance, if you earn Rs. 50,000 in rental income annually and your expenses amount to Rs. 15,000 (covering property taxes, maintenance, and repairs), the net rental income would be Rs. 35,000. Therefore, the Zakat on the rental property would be Rs. 875 (2.5% of Rs. 35,000).

Remember, Zakat on a rental property is only required if the net rental income exceeds the Nisab threshold. If it's below the Nisab, then Zakat on a rental property isn't obligatory.

Zakat on Investment Property

Zakat on investment properties is obligatory for those who own properties used for investments, like rental properties or commercial spaces.

For the following investments in property, zakat is due:

- Farmland for sale

- Buying a plot for capital gains

- Purchasing a shop/office/building for resale and profit.

The calculation for zakat on investment property is 2.5% of the property's market value.

For instance, if you own a rental property valued at 500,000 rupees, the zakat on investment property would be 12,500 rupees (2.5% of 500,000). Remember, zakat on investment property applies only if the property's market value exceeds the Nisab.

Zakat on Land Property

Zakat on land property is for those who own undeveloped land for investment. It's 2.5% of the land's market value.

For instance, if your land is valued at Rs. 150,000, zakat would be Rs. 3,750 (2.5% of Rs. 150,000).

Remember, zakat is due only if the land's value is above the Nisab.

Farming land

Zakat doesn't apply to farmland used for a specific purpose unless it's bought and sold as a commodity. There is no Zakat on agricultural land unless bought for sale. But the produce, like fruits, vegetables, and cattle, is Zakatable.

If leased, the money kept after a lunar year is considered as cash and applies to Zakat obligations for cash assets.

Bare Land

Vacant or cleared land without a residence or produce, like agricultural land, isn't Zakatable.

Leased land

For any leased land, only the rent is Zakatable. After expenses, all rent collected at the end of a lunar year is Zakatable.

Construction Land

Land for constructing a building, subdividing into lots, or consolidating into fewer lots is Zakatable as it's a business transaction. If you are constructing a house for your residence, there is no Zakat applicable on the property under construction.

Zakat on Commercial Property

Here are the specifics of Zakat on commercial property:

- Commercial Leasing: Zakat does not apply to the commercial property itself. However, if it's leased out, the rental income becomes zakatable after a lunar year.

- Commercial Selling: When a commercial property is sold, it becomes zakatable. Since commercial properties are assets intended for business, their sale is considered a commodity, making them obliged to Zakat regardless of when they are sold.

Zakat on Mortgage

Mortgage payments are not subtracted from your Zakatable assets. Scholars allow for the deduction of up to one year's worth of the non-interest portion of the payments.

However, this should only be done if it significantly impacts one's ability to repay on time. If it's an Islamic home purchase plan, these are not considered debts, hence not deductible.

For zakat on rental property with mortgage:

Zakat = 2.5% of the Net Rental Income - Mortgage Principal Payment |

You can only deduct the portion of the mortgage payment that goes toward the principal, not the interest.

Zakat on Installment Property

Zakat will be obligatory if you purchase a property through installments.

For instance, Zakat on a plot bought through installments is 2.5% of the equity in the property. If the equity in the property is Rs. 100,000, the Zakat amount would be Rs. 2,500.

Zakat on Real Estate

Here's the Zakat payment for real estate investments:

- All real estate investments not designated for personal use must be included when calculating Zakat Nisab.

- For rental properties, Zakat is calculated as 2.5% of the gross annual rent.

- Real estate agents are obligated to pay Zakat on their invested properties, excluding their office and primary residence. Zakat is due after one year, with debts deducted at a rate of 1/40.

- Zakat is assessed based on the property's current value at the end of the year, regardless of depreciation or appreciation.

- Agricultural land is exempt from Zakat, but Zakat is calculated based on its produce. If the land is naturally irrigated, Zakat is 10% of the yield, while for artificially irrigated land, Zakat is 5%.

Facts about Zakat on Property

Here are some facts about zakat on property you need to know:

- The house where you reside is excluded from Zakat obligations.

- Zakat on property for sale is obligatory for properties or assets acquired with the intent of resale, as they are subject to Zakat.

- If the intention behind acquiring a property is not for investment or resale, it may not be liable for Zakat. For instance, purchasing a second property solely for investment purposes, not including it from Zakat, as it's a long-term investment.

- However, if the intention changes to selling the property, Zakat becomes applicable.

- Regarding fixed assets like land, Zakat is contingent upon usage and intention. If the land is inherited or bought without a specific intent or as a wealth reserve, Zakat isn't obligatory.

- Zakat is due on the approximate sale value of the land annually if it's acquired for investment. This necessitates yearly valuation to assess changes in value. Payment can be deferred until the land is sold, but it remains due for each previous year based on the land's value at the time.

- There is no zakat on the under-construction property.

Difference Between Zakat and Tax

By following the table, you’ll be able to understand the difference between zakat and tax:

Aspect | Zakat | Tax |

Nature | Religious obligation | Government levy |

Religious Significance | Holds religious sanctity | Does not hold religious significance |

Applicability | Obligatory only for Muslims | Applicable to all citizens |

Regulation | Fixed by the Holy Quran

| Governed by government regulations |

Rate | Fixed at 2.5% of annual income | Determined by government regulations |

Flexibility | Rate remains unchanged | Can be adjusted by the government |

Sources | Fixed sources according to Islamic teachings | Varies based on government needs |

Recipients | Given to specific recipients of surplus wealth | Applies to all citizens |

Distribution | Given directly to recipients | Collected by the government |

In conclusion, understanding Zakat on property is crucial for Muslims. While certain properties may be exempt, such as residential homes, others, like those bought for resale or rental income, require Zakat. By following the guidelines and calculations provided, individuals can fulfill their religious obligation and contribute positively to the community.

When children lose their families, they don’t just need a roof—they need warmth, structure, and connection. That’s exactly what Pakistan Sweet Home’s orphanage center is built to offer. Here, every child receives more than basic care—they’re treated with the dignity and love every child deserves.

Light Up an Orphan's World With Your Zakat

info@pakistansweethome.org.pk

(051) 4865856

+92 335 1118477